Moody's - Emerging green technologies will diversify sustainable debt markets

Moody’s Ratings expects emerging green technologies like CCUS, low-carbon hydrogen, biofuels and nuclear to diversify sustainable bond issuance by sector and project type, with an increased emphasis on credible emission thresholds.

Moody's, 30 Ott 2024 - 09:53

Governments globally have ramped up support for development and production of mature and emerging green technologies to accelerate decarbonization efforts, secure energy supply and boost competitiveness. In particular, policy support is increasing for clean energy technologies that are not yet available at scale, including carbon capture utilization and storage (CCUS), low-carbon hydrogen, biofuels and new nuclear energy technologies.

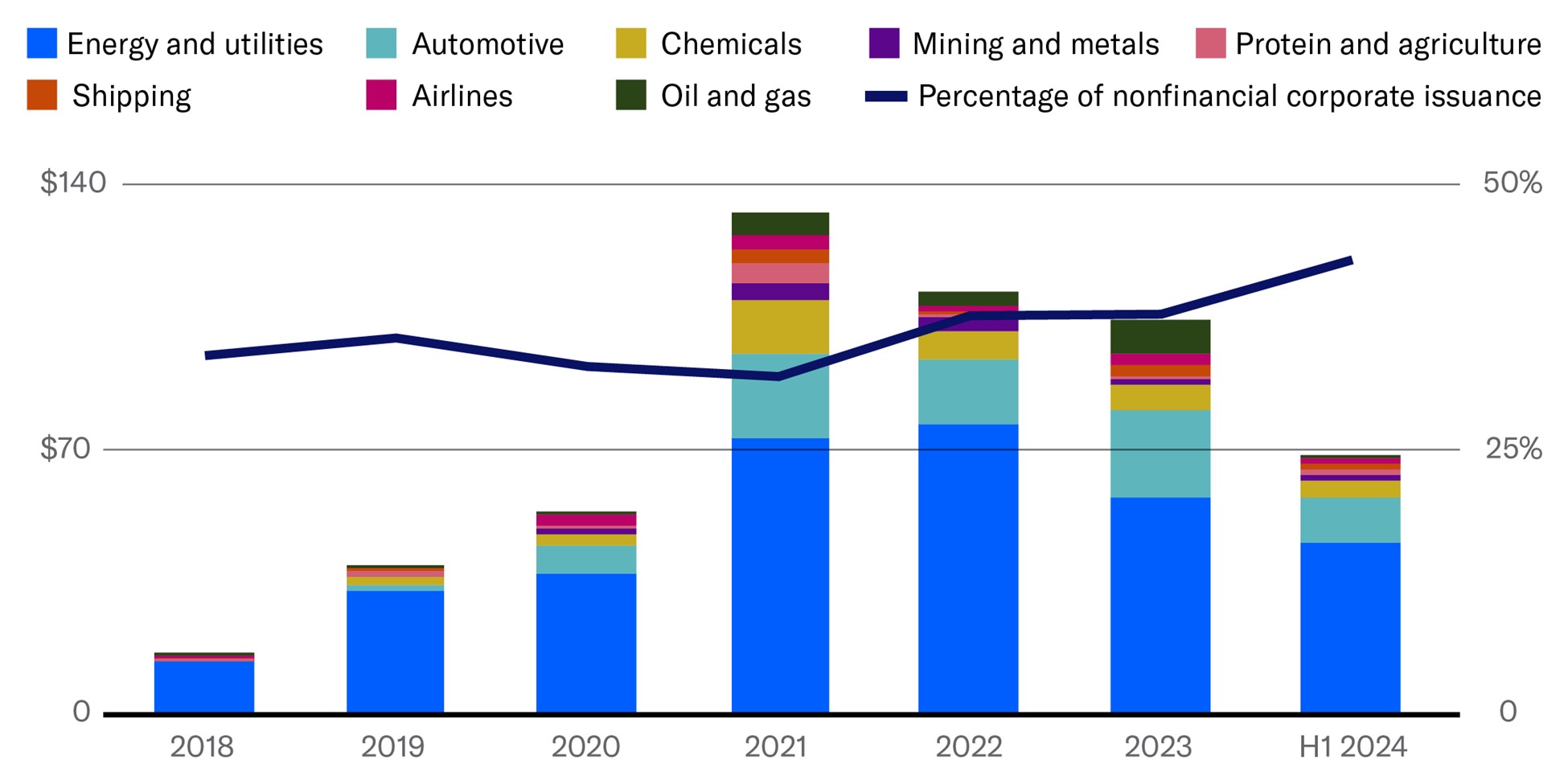

Given the increase in investment in these emerging technologies that would be required to meet net zero-aligned pathways, innovative financing solutions will likely be needed. One such area is the sustainable debt market. Companies with elevated carbon transition risks and aiming to finance increasingly ambitious decarbonization plans have already been active in the sustainable bond market. We estimate that issuance from the most exposed carbon transition sectors has totaled $525 billion since 2018, with $68 billion in the first half of 2024 accounting for 13% of global sustainable bond volumes and 43% of volumes from nonfinancial companies (Exhibit 1).

EXHIBIT 1

Sectors assessed to be most exposed to carbon transition risk accounted for 43% of nonfinancial corporate sustainable bond issuance in H1 2024 [1]

Sustainable bond issuance in nonfinancial corporate sectors with very high or high inherent exposure to carbon transition risk ($ billions)

Sources: Environmental Finance Data and Moody's Ratings

Around 80% of issuance since 2018 has come from the power and automotive sectors, where scalable decarbonization solutions generally already exist. Mature technologies have garnered the bulk of government and corporate investment.

Emerging green technologies will likely become a growing fixture in sustainable bond frameworks as strong policy support helps improve their cost competitiveness. In hard-to-abate sectors where low-carbon technologies are largely not available at scale – like steel, cement, shipping and aviation – the rollout of new technologies is an important component of sectoral decarbonization pathways. Although these sectors have been relatively minor contributors to sustainable bond volumes in recent years, the growth of emerging green technologies could incentivize companies to enter the market, diversifying projects and sectoral issuance over time and supporting companies' transition plans.

While increased investment in emerging green technologies has the potential to drive higher sustainable bond volumes, technologies in several hard-to-abate sectors carry potential sustainability quality and comparability risks that may complicate their inclusion in sustainable financing frameworks. In the case of hydrogen projects, for example, carbon-intensity thresholds needed to qualify as green or clean hydrogen can vary across geographies and standards, while the use case of the hydrogen produced also has implications for how effective it is as a decarbonization agent.

With growing market attention on perceived greenwashing and the quality of projects financed by sustainable bonds, there will likely be growing emphasis on credible thresholds and management of potential carbon lock-in and environmental and social externalities. Investors and other market participants are also likely to increasingly scrutinize how emerging green technologies financed under sustainable finance frameworks align with credible entity-level decarbonization strategies.

Companies with ambitious and clear emissions reduction targets and effective implementation strategies can position themselves to seize opportunities in emerging green businesses and technologies and can use sustainable finance to fund capital spending. They can also mitigate policy and market credit risks by clearly articulating the ambition of their decarbonization targets and the quality of their implementation plans. For example, Italian natural gas distributor Snam S.p.A issued its maiden €1 billion sustainability-linked bond in February this year, with targets linked to a reduction in scope 1, 2 and 3 emissions. Moody’s Ratings assigned a Net Zero Assessment to Snam's entity-level decarbonization plan, with a score of NZ-3 (significant).

It is the sole responsibility of the Sustainable Finance Partner to check the truthfulness, accuracy and completeness of the data and information entered on this web page, when within its competence and provided by the Partner. Borsa Italiana S.p.A. is not responsible for the contents developed by third parties and in particular by the Sustainable Finance Partners contained in this web page.

Hai dei dubbi su qualche definizione? Consulta il glossario finanziario di Borsa Italiana.