ERM - Ahead of the climate curve

Integrating climate transition plans into corporate strategies is essential for anticipating risks. Proactive, regulation-compliant approaches empower businesses to navigate the low-carbon economy, mitigate risks, and seize opportunities

ERM, 30 Ott 2024 - 09:56

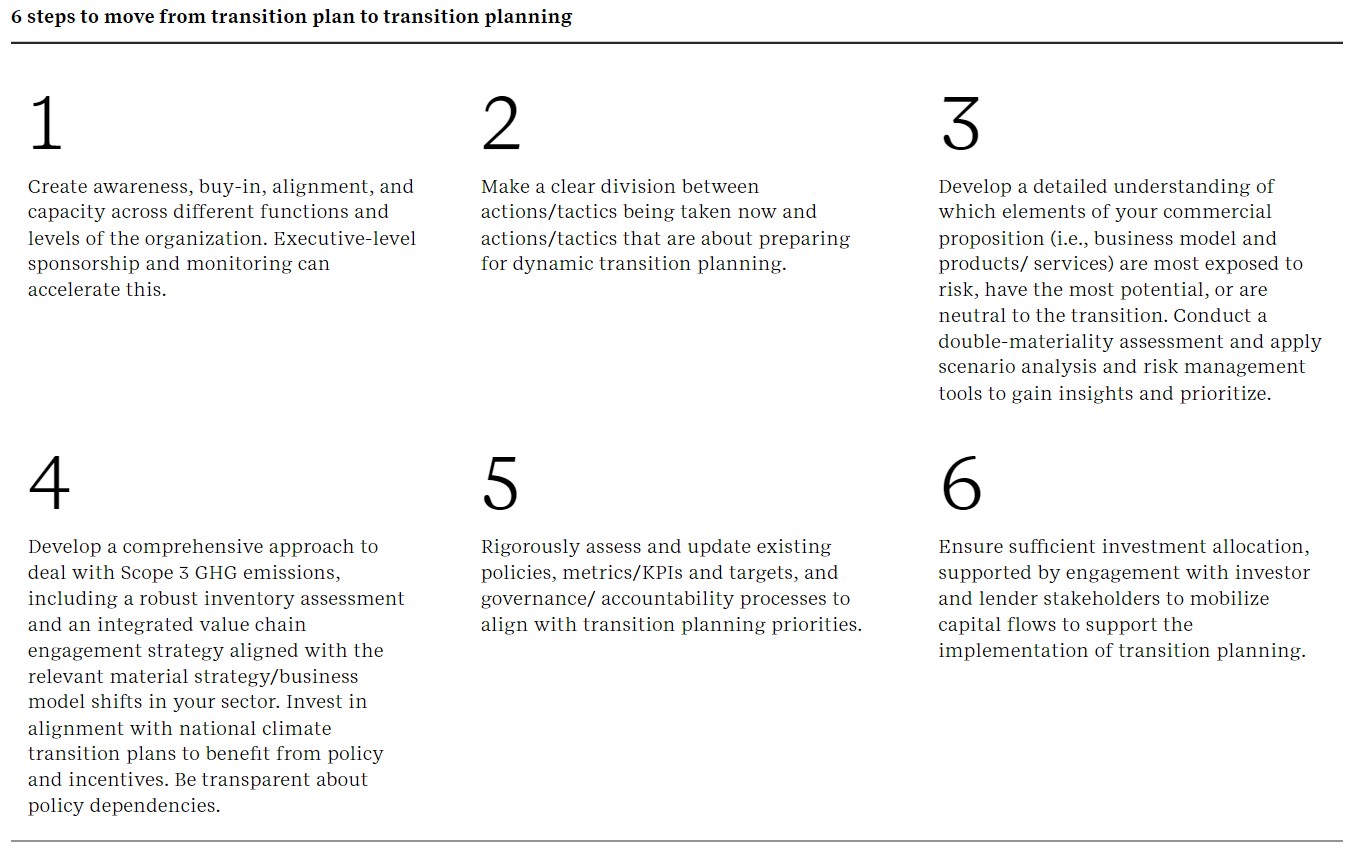

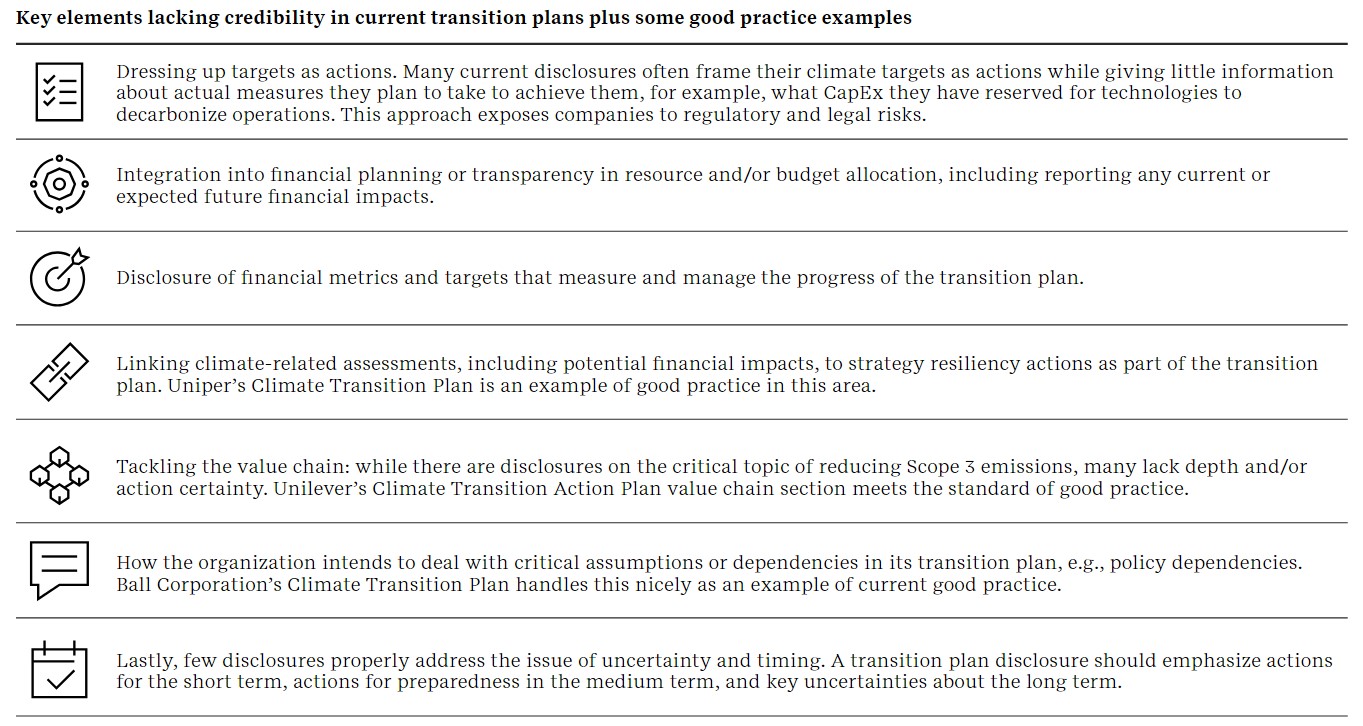

With the rapid shift toward a low-carbon economy, businesses face increasing pressure to align with climate goals. Companies that are "ahead of the climate curve" are those that develop and implement robust climate transition plans. These plans outline how businesses can adapt their operations to minimize carbon emissions, meet regulatory requirements, and capitalize on opportunities arising from global climate action.

As the world moves closer to the deadlines set by international climate agreements, companies that delay action risk facing significant financial penalties and reputational damage.

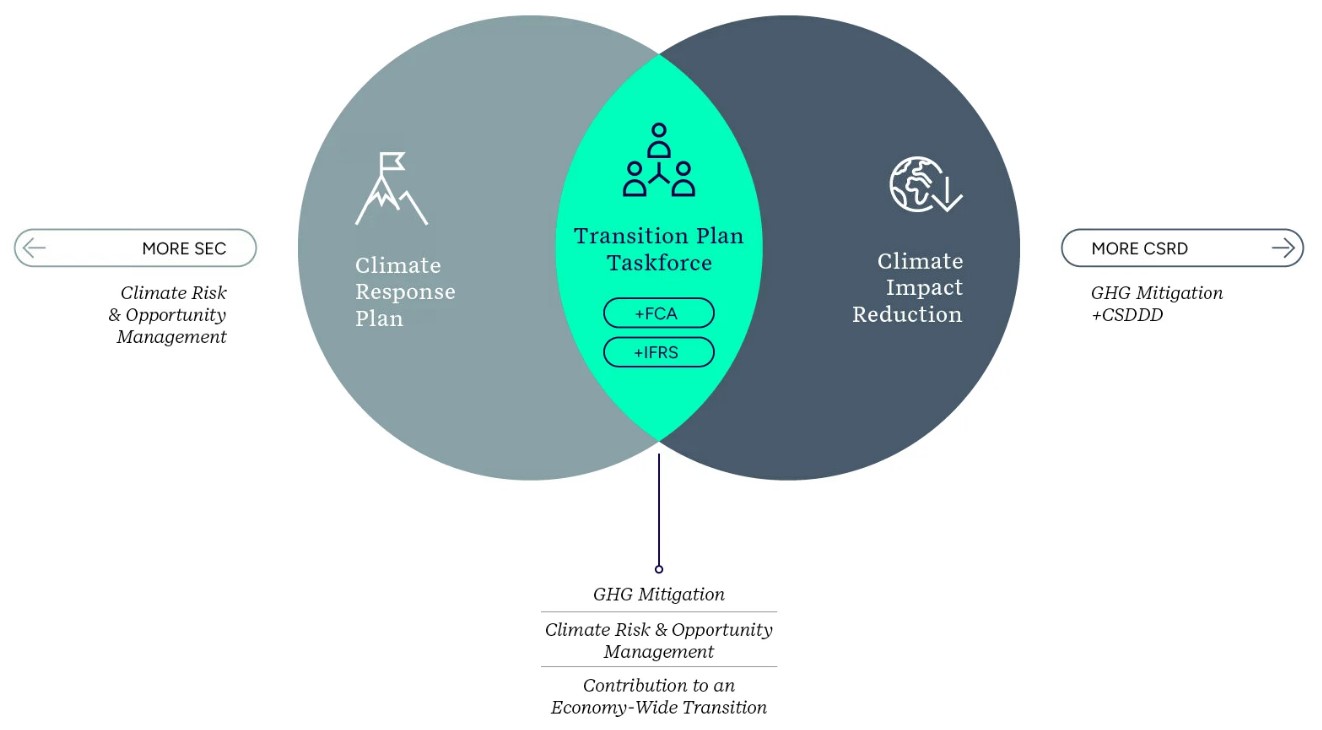

Regulatory bodies like the ISSB (International Sustainability Standards Board) and CSRD (Corporate Sustainability Reporting Directive) are introducing stringent disclosure requirements that demand transparency on climate-related financial risks. Firms must now quantify the financial impacts of climate change on their business models, operations, and supply chains.

Key to managing this transition is the ability to understand both physical and transition risks. Physical risks refer to the direct consequences of climate change, such as extreme weather events, which can disrupt business operations.

Graph 1: Taking the middle Ground

Transition risks, on the other hand, involve the economic and policy shifts as countries adopt stricter carbon regulations.

By preparing for both, companies can better protect their value and ensure long-term resilience.

Moreover, companies that adopt a forward-looking approach to climate transition planning can unlock significant growth opportunities. As demand for green technologies and sustainable products increases, early adopters can position themselves as leaders in emerging markets. For example, transitioning to renewable energy sources or adopting circular economy practices can help businesses not only reduce costs but also attract environmentally conscious investors and consumers.

Ultimately, companies that are proactive in addressing climate risks—through rigorous planning, innovation, and transparent reporting—will not only avoid the pitfalls of regulatory non-compliance but also thrive in a rapidly changing economic landscape. Staying ahead of the climate curve is not just about avoiding risks; it’s about leveraging the transition to create value and drive sustainable growth.

More information and full article can be found at Ahead of the Climate Curve: Leveraging climate transition planning to prepare for a low-carbon future (erm.com)

Hai dei dubbi su qualche definizione? Consulta il glossario finanziario di Borsa Italiana.